Student Debt Is Ruining America

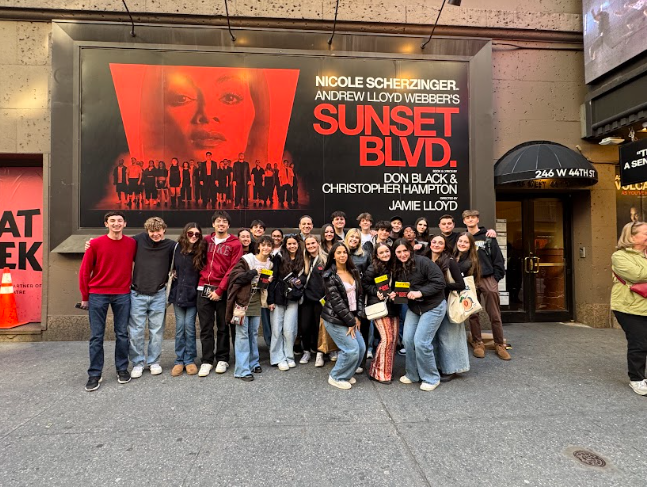

Photo courtesy of Ashian Islam

NYU’s Stern School of Business

Americans are drowning in student debt. According to the Chamber of Commerce website, the average student who took out a loan in 2016 for a four-year degree currently owes $37,102, and the total student debt in the nation amounts to more than $1.5 trillion. The issue of student debt is plaguing the nation, as millions of Americans are crushed by their loan payments each month.

Things were not always this way. According to the National Center for Education Statistics, the average tuition at a four-year, in-state university in 1990 was $3,958, meaning it cost an average of $15,832 for all four years. In 2021, the average was $16,618 per year, making the grand total $66, 472. These figures do not include the cost of room and board for students living on campus. Because the average American cannot pay these absurd prices out-of-pocket, many take out student loans, offered by both the federal government and private companies.

Americans experience an overwhelming amount of stress from taking out loans. This stress, which takes its toll on the human body, can cause a lack of focus, depression, and other disorders. To make matters worse, many who bought into the idea that taking out expensive loans would be worth it in the long run are discovering that that was not the case.

Many elected officials have come into office with the promise of lowering student loan interest rates and tuition altogether, but that promise has not been adequately fulfilled in the last 30 years, and the average tuition and student loan interest rates have only risen higher since. In Sept. 2022, President Joe Biden did forgive $10,000 of student loan debt for anyone who earned less than $125,000 per year. While this move can alleviate debt for many, it does not fully remedy the struggles many Americans are facing, nor does it address preventing more people from accruing debt in the future. Student loans cause a vicious cycle–because students are able to take out hundreds of thousands of dollars in loans, colleges are able to charge such outrageous tuition. People then take out more loans to pay the increasing tuition, and the cycle continues. Nothing is stopping the next class of college students from falling into the same struggles as those who came before them.

Daryl Lloyd, a student at Florida State University, said that he was a communications major in his third year at the school. Including tuition, room, and board, Lloyd claimed he is in $87,000 of student loan debt. “Everybody that can’t afford to pay for [college] out of pocket has to get it from somewhere else, so we were forced to take these large loans, but I feel like these universities and loan agencies are exploiting students because they know they have nowhere left to turn if they want an education in this country,” Lloyd said.

Emily Someis, who attended Cal Maritime and graduated in 2019, was a mechanical engineering major that graduated with $118,000 in debt. She claimed she is currently unemployed, previously working at a startup that had failed, eventually leaving her jobless. “I hated the fact that I had to take out a student loan. I was supposed to receive a partial scholarship to help, but was stripped of the opportunity, because I could not qualify with my grades. I was forced into taking that loan and thought about dropping out numerous times, but could not, because I was already too far in debt,” Someis said.

Jared Yizer, a student at Montana State University, who currently majors in economics, said he is currently in $46,000 of debt in his fourth year at the university. “Student loans aren’t a bad thing. The fact that so many people have to take one is a bad thing,” Yizer said.

The crushing weight of student debt is ruining America’s lives. Despite the recent federal efforts, the climbing costs of attending college and the prevalence of five-and-six-figure loans is a major problem in the nation.